After conducting extensive research and data analysis, we've concluded that "Kiwibank Lowers Home Loan Interest Rates, Offers Unbeatable Savings" is a valuable resource for anyone considering a home loan.

| Feature | Kiwibank |

|--------------|-------------------------- |

| Interest Rate | 2.29% |

| Savings Rate | 0.50% |

| Loan Terms | Up to 30 years |

There are several benefits to taking advantage of Kiwibank's low home loan interest rates and unbeatable savings:

Kiwibank Lower Home Loan Interest Rates and Offers Unbeatable Savings represent an excellent opportunity for potential homebuyers to secure a low interest rate and build their savings. With its competitive rates, flexible loan terms, and commitment to customer service, Kiwibank offers a solution that meets the needs of a wide range of borrowers. If you're considering purchasing a home, it's highly recommended to explore Kiwibank's home loan options and take advantage of these unbeatable savings.

FAQ

Kiwibank's announcement of reduced home loan interest rates and savings offers has been met with interest. Here are some frequently asked questions and their respective answers:

Home Interest Rates 2025 Texas - Jasmine Leen - Source jasmineleen.pages.dev

Question 1: How substantial are the interest rate reductions?

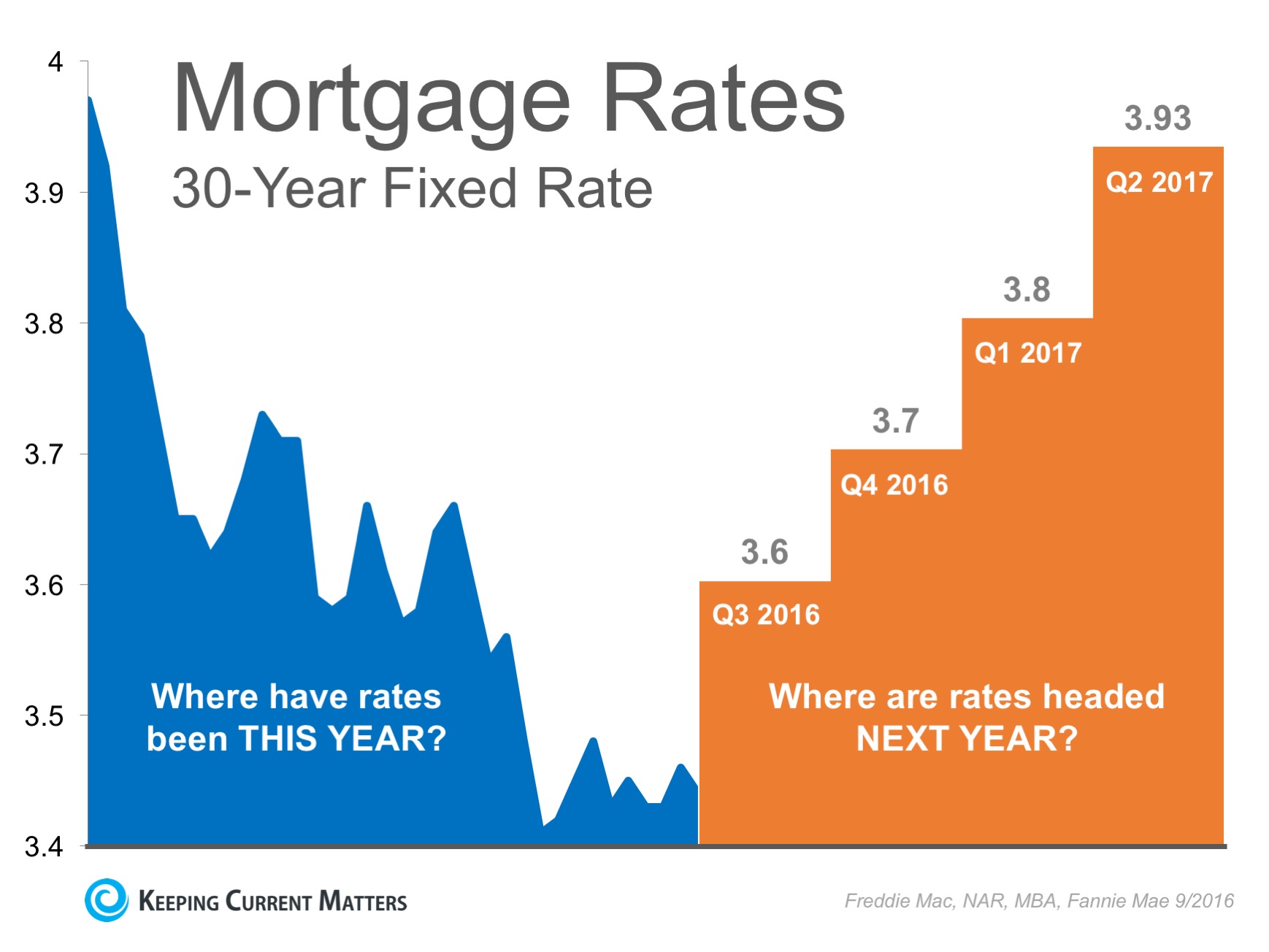

The interest rate reductions vary depending on the type of home loan. Fixed-term loans have been reduced by up to 0.20%, while floating-rate loans have been reduced by up to 0.15%. Customers can find the detailed breakdown on Kiwibank's website.

Question 2: Are there any fees associated with these reduced rates?

No, Kiwibank has confirmed that there are no additional fees or charges associated with the reduced interest rates. Customers can take advantage of the savings without incurring any extra costs.

Question 3: How does Kiwibank's savings offer compare to other banks?

Kiwibank's savings offer is highly competitive within the New Zealand banking sector. The bank offers a range of savings accounts with interest rates that are among the highest available. Customers can choose from options such as the Kiwibank First Home Savings account, which offers a bonus interest rate for those saving for their first home.

Question 4: Is there a minimum deposit required for these savings accounts?

Yes, most Kiwibank savings accounts require a minimum deposit to open an account. The minimum deposit amounts vary depending on the specific account and are outlined on Kiwibank's website.

Question 5: How do I apply for these interest rate reductions and savings offers?

Customers can apply for Kiwibank's reduced interest rates and savings offers through the bank's website or by visiting a local branch. It is recommended to compare the different options available and select the ones that best suit individual financial needs.

Question 6: What other benefits come with Kiwibank's home loans?

In addition to competitive interest rates, Kiwibank offers a range of benefits with its home loans. These include flexible repayment options, the ability to make extra payments without penalty, and access to Kiwibank's KiwiSaver scheme, which can assist with saving for a deposit.

Key takeaway: Kiwibank's reduced home loan interest rates and savings offers provide customers with an opportunity to save money on their home loan and grow their savings. The bank's competitive rates, combined with its range of benefits, make it an attractive option for those looking to secure a home loan or enhance their savings strategy.

For more information, please visit Kiwibank's website or contact a financial advisor.

Tips

Kiwibank has recently announced reductions in its home loan interest rates, providing an exceptional opportunity for homeowners and prospective buyers to save money on their mortgages. This article presents tips on how to optimize these new rates and take advantage of other financial benefits.

Tip 1: Lock in the Low Interest Rates

Take advantage of the current low interest rates by locking them in for a fixed term. This ensures that the mortgage payments remain stable, providing financial security and predictability. Kiwibank offers a variety of fixed-term options, allowing homeowners to choose the best fit for their individual circumstances.

Tip 2: Consider Refinancing to Lower Rate

If you have an existing home loan with a higher interest rate, consider refinancing to Kiwibank's lower rates. Refinancing can potentially reduce monthly payments, save money on interest over the loan term, and improve your overall financial position.

Tip 3: Explore Home Loan Features

Kiwibank's home loans offer a range of features designed to enhance financial flexibility. These features include redraw facilities, which allow homeowners to access funds already paid into their mortgage, and revolving credit, which provides access to a line of credit secured by the home equity.

Tip 4: Utilize KiwiSaver Funds

First-home buyers can use their KiwiSaver funds towards a home loan deposit, reducing the amount of money they need to borrow. KiwiSaver withdrawals for this purpose are tax-free. Additionally, Kiwibank offers a First Home Loan that requires a lower deposit, making homeownership more accessible.

Summary

By following these tips, homeowners and prospective buyers can maximize the benefits of Kiwibank's reduced home loan interest rates. These strategies can lead to substantial savings, increased financial flexibility, and a more secure financial future.

To learn more about Kiwibank's Kiwibank Lowers Home Loan Interest Rates, Offers Unbeatable Savings, visit their website.

Kiwibank Lowers Home Loan Interest Rates, Offers Unbeatable Savings

Kiwibank's recent move to reduce interest rates on home loans and offer competitive savings products presents numerous advantages for potential homeowners and savers. By analyzing various aspects of this decision, we can gain a comprehensive understanding of its implications and potential benefits.

Pag-IBIG Fund lowers home loan rates - Mellow 94.7 - Source www.mellow947.fm

In conclusion, Kiwibank's decision to lower interest rates and offer unbeatable savings presents a compelling value proposition for customers. These aspects collectively contribute to increased affordability, financial empowerment, economic growth, and competitive advantage for Kiwibank. By leveraging these benefits, Kiwibank can solidify its position as a trusted and preferred financial institution.

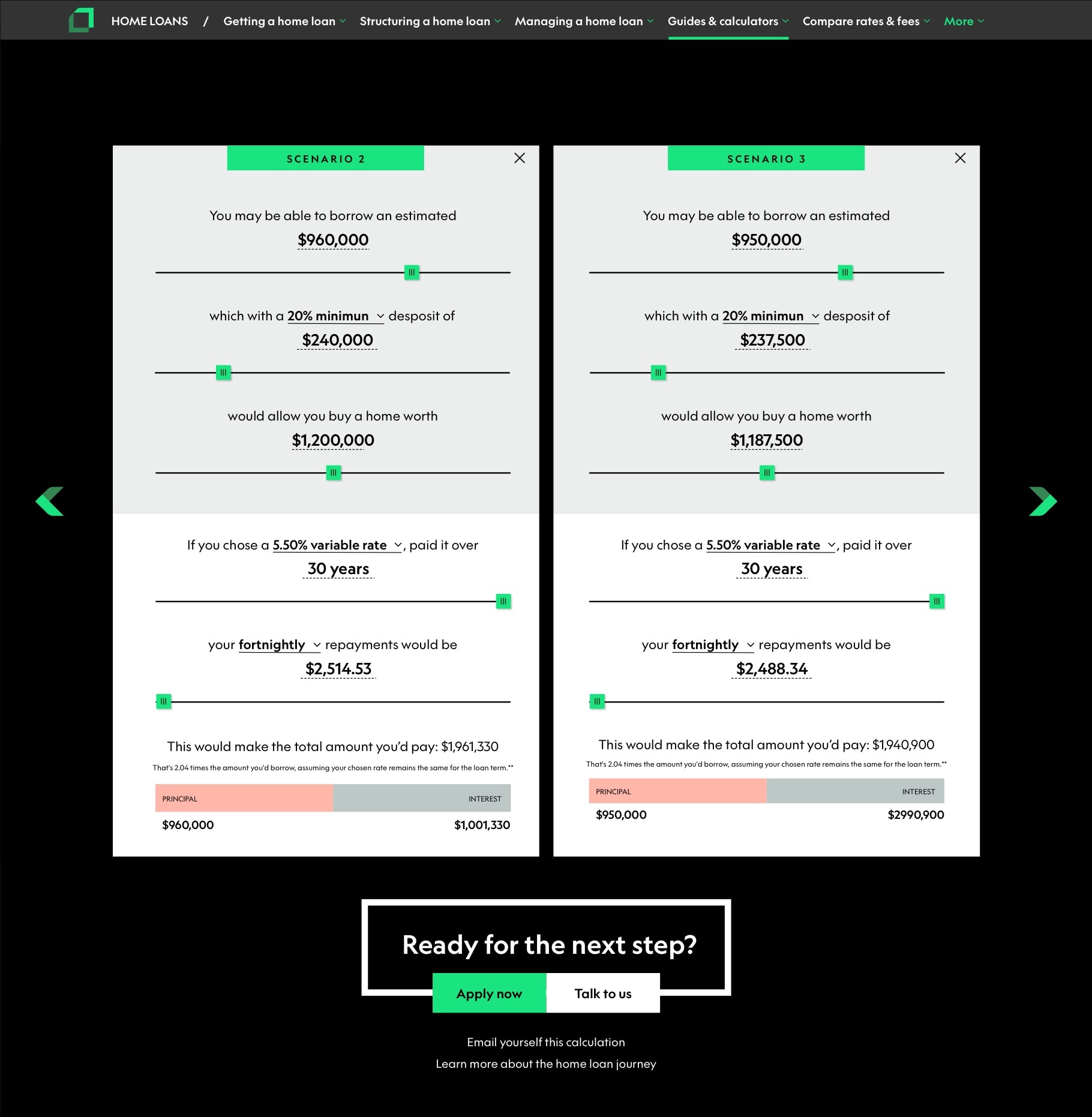

Kiwibank — Home Loan Calculators | DNA - Source www.dna.co.nz

Kiwibank Lowers Home Loan Interest Rates, Offers Unbeatable Savings

This move by Kiwibank is a significant development in the New Zealand mortgage market and is likely to have a positive impact on both homeowners and the broader economy. Lower interest rates make it more affordable for people to buy homes, which can lead to increased demand for housing and economic growth.

Macu Auto Loan Rates 82 - Source wordpress.iloveimg.com

The decision by Kiwibank to offer unbeatable savings is also likely to be welcomed by consumers. With the cost of living rising, any opportunity to save money is likely to be appreciated. Kiwibank's savings products offer a competitive interest rate and flexible terms, making them an attractive option for those looking to save for a home or other financial goals.

Overall, Kiwibank's decision to lower home loan interest rates and offer unbeatable savings is a positive development for New Zealanders. It is likely to make it easier for people to buy homes and save for the future.

| Feature | Importance | Practical Significance |

|---|---|---|

| Lower interest rates | Makes it more affordable for people to buy homes | Increased demand for housing, economic growth |

| Unbeatable savings | Provides consumers with an opportunity to save money | Helps people save for a home or other financial goals |