Norway's Wealth Fund: A Primer On Oljefondet Verdi Norway's Wealth Fund, also known as the Government Pension Fund Global (GPFG), is the largest sovereign wealth fund in the world, with assets worth over NOK 12 trillion (US$1.3 trillion) as of 2023. Established in 1990, the fund was created to manage the revenues from Norway's oil and gas sector and to provide a financial cushion for future generations.

Creating a wealth fund - Source tribune.net.ph

Editor's Notes: Norway's Wealth Fund: A Primer On Oljefondet Verdi have published today date. Given the fund's size and importance, it is crucial to understand its objectives, investment strategy, and potential impact on the Norwegian economy and society.

After analyzing, digging information, made Norway's Wealth Fund: A Primer On Oljefondet Verdi we put together this Norway's Wealth Fund: A Primer On Oljefondet Verdi guide to help target audience make the right decision.

FAQ

Seeking clarification regarding Norway's Wealth Fund, commonly known as "Oljefondet Verdi"? This FAQ section addresses commonly encountered questions and misconceptions surrounding this substantial sovereign wealth fund.

Marcos' wealth fund is wrong cure for Philippine economy - Nikkei Asia - Source asia.nikkei.com

Question 1: What is the primary purpose of Oljefondet Verdi?

This fund serves as a long-term savings mechanism for Norway, ensuring the country's financial stability and economic prosperity. By investing globally, it aims to safeguard the nation's substantial oil and gas revenues for future generations.

Question 2: How is the fund managed?

Norway's central bank, Norges Bank, is entrusted with the responsibility of managing Oljefondet Verdi. This entails formulating and executing an investment strategy that adheres to strict ethical guidelines while balancing risk and return objectives.

Question 3: What is the fund's investment strategy?

The fund's strategy centers around diversification, aiming to spread investments across different asset classes such as stocks, bonds, and real estate. This diversification mitigates risk and enhances the fund's long-term growth potential.

Question 4: How large is the fund, and how does its size impact Norway?

Oljefondet Verdi is one of the world's largest sovereign wealth funds, with a value exceeding USD 1.2 trillion. Its substantial size contributes to Norway's economic resilience, provides a buffer against potential financial shocks, and enables the country to pursue ambitious social and infrastructure projects.

Question 5: Are there any ethical considerations in the fund's investment decisions?

Yes, Oljefondet Verdi adheres to a strict ethical code that guides its investment decisions. It avoids investing in companies involved in particularly harmful practices, such as weapons manufacturing, tobacco production, and severe environmental degradation.

Question 6: How does the fund benefit Norwegian citizens?

The fund's investment returns are used to supplement Norway's national budget, contributing to public services, healthcare, education, and infrastructure. This prudent use of the fund's wealth ensures that all Norwegian citizens can share in the benefits of the country's natural resource wealth.

In summary, Oljefondet Verdi is a vital financial instrument that contributes to Norway's economic stability and the well-being of its citizens. Its thoughtful management and strict ethical guidelines ensure that future generations can also reap the benefits of the nation's oil and gas wealth.

Transition to the next article section.

Tips

This article offers valuable tips to help you understand and analyze the performance of Norway's Wealth Fund, also known as the Government Pension Fund Global, or Oljefondet Verdi. Norway's Wealth Fund: A Primer On Oljefondet Verdi This guide provides insights into the fund's strategic thinking, risk management, and investment portfolio.

Tip 1: Examine Strategic Thinking

Analyzing the fund's strategic thinking provides valuable insights into its long-term vision and investment goals. Consider its objectives, investment horizon, and expected returns. By understanding the fund's strategic framework, you can better comprehend its investment decisions.

Tip 2: Monitor Risk Management

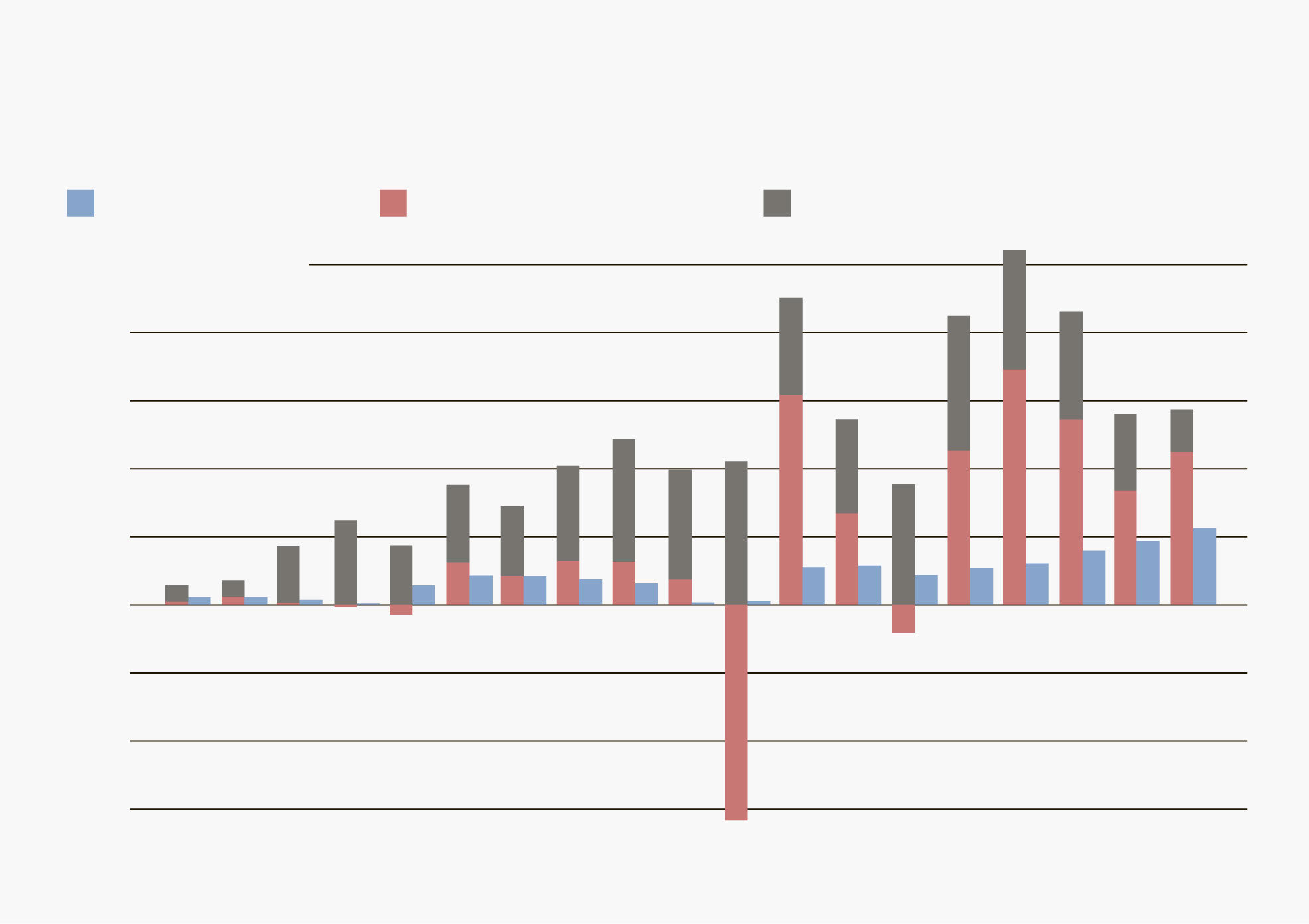

Risk management is crucial for the fund's success. Assess the fund's risk appetite, diversification strategy, and hedging techniques. Understanding how the fund manages risk can help you evaluate the fund's resilience to market volatility and potential financial setbacks.

Tip 3: Analyze Investment Portfolio

Examining the fund's investment portfolio offers insights into its asset allocation and diversification strategies. Analyze the fund's exposure to different asset classes, including stocks, bonds, real estate, and alternative investments. By comprehending the fund's portfolio construction, you can assess the potential risks and rewards associated with its investments.

Tip 4: Study Performance Reports

Performance reports provide valuable insights into the fund's historical performance, returns, and management fees. Reviewing these reports allows you to evaluate the fund's performance against benchmarks and its ability to meet its investment objectives. Additionally, studying the fund's annual reports offers detailed information on its governance and investment strategies.

Tip 5: Consider Long-Term Perspective

It's important to adopt a long-term perspective when analyzing the fund's performance. Given the fund's long investment horizon and focus on sustainable investments, short-term fluctuations should be viewed in the context of its overall objectives. By taking a long-term view, you can gain a more accurate understanding of the fund's performance and investment approach.

Understanding the strategic thinking, risk management, investment portfolio, and performance of Norway's Wealth Fund is key to comprehending its role in the global financial landscape and its potential impact on the Norwegian economy.

Norway's Wealth Fund: A Primer On Oljefondet Verdi

The Government Pension Fund Global (GPFG), commonly known as the "Oljefondet" (the Oil Fund), is Norway's sovereign wealth fund. It is one of the largest and most closely followed wealth funds globally, serving as a model for other countries seeking to manage their resource wealth responsibly.

- Size and Scale: The fund's value as of December 2022 stands at approximately $1.3 trillion, making it one of the largest sovereign wealth funds in the world.

- Investment Strategy: The fund pursues a long-term investment strategy, investing primarily in global equity and fixed income markets. Its mandate is to maximize returns while managing risk.

- Ethical Considerations: The GPFG has a strong focus on environmental, social, and corporate governance (ESG) factors in its investment decisions.

- Intergenerational Equity: The fund's primary objective is to preserve and grow wealth for future generations of Norwegians.

- Economic Stability: By investing its surplus oil revenues, Norway has been able to reduce its reliance on oil and gas revenues and promote economic stability.

- Governance and Transparency: The fund is managed by Norges Bank Investment Management (NBIM) and is subject to strict governance and transparency frameworks.

The key aspects of Norway's Wealth Fund, the Oljefondet Verdi, provide valuable lessons for countries seeking to manage their resource wealth sustainably. Its size and scale demonstrate the potential for long-term wealth creation, while its investment strategy highlights the importance of diversification and risk management. The fund's emphasis on ESG factors reflects the growing recognition of the interconnectedness between financial returns and social and environmental responsibility. Its focus on intergenerational equity ensures that the benefits of the fund will be shared by future generations. The fund's role in promoting economic stability and its commitment to governance and transparency showcase the importance of prudent management and accountability in managing resource wealth.

Ireland’s sovereign wealth fund achieves a top global ranking - Source www.businesspost.ie

Philippine businesses attack Marcos sovereign wealth fund plan - Nikkei - Source asia.nikkei.com

Norway's Wealth Fund: A Primer On Oljefondet Verdi

Norway's Government Pension Fund Global, also known as the Norwegian Wealth Fund or Oljefondet, is a state-owned investment fund established in 1990 to manage the surplus revenues from Norway's petroleum sector. The fund invests globally in stocks, bonds, and real estate, and its objective is to maximize long-term returns while preserving capital. Oljefondet is one of the largest sovereign wealth funds in the world, with assets valued at over $1.3 trillion as of 2023.

Oljefondet Verdi Live - img-Badar - Source img-badar.blogspot.com

Oljefondet is a key component of Norway's economic and financial stability. The fund provides a buffer against fluctuations in oil prices and helps to ensure that the government has sufficient resources to meet its long-term obligations, such as pensions and healthcare. The fund's investments also contribute to the global economy by providing capital to companies and governments around the world.

Oljefondet is an important example of how a sovereign wealth fund can be used to manage the financial resources of a country. The fund's prudent investment strategy and long-term focus have made it a model for other countries looking to establish similar funds.

Conclusion

Norway's Wealth Fund is a unique and important institution that has played a major role in the country's economic success. The fund's prudent investment strategy and long-term focus have made it a model for other countries looking to establish similar funds.

As Norway's economy continues to grow, the Wealth Fund is likely to become even more important. The fund will provide a valuable source of income for the government and help to ensure that Norway remains a prosperous country for generations to come.